Managing personal finances can often feel like navigating through a maze of numbers and expenses. However, with the right tools and strategies, you can take control of your financial situation and pave the way for a more secure future. One such tool that proves invaluable in this journey is Microsoft Excel. In this article, we will delve into the realm of personal finance management using MS Excel, focusing on budgeting and expense tracking.

Introduction to Personal Finance Management

When it comes to managing your personal finances, it’s essential to have a clear understanding of your income, expenses, and financial goals. This knowledge forms the foundation of effective financial planning.

The Importance of Budgeting

A budget serves as your financial roadmap, helping you allocate funds to various expenses while ensuring you don’t overspend. It empowers you to make informed decisions about your money.

Getting Started with MS Excel for Personal Finance

Getting started with MS Excel for personal finance is a pivotal step towards organizing your financial journey. The process begins with the creation of a dedicated workbook tailored to your financial needs. This workbook serves as a centralized hub for all your financial data and activities. Within the workbook, you’ll construct individual sheets to address various aspects of your financial life, allowing for systematic management and analysis.

Setting up your workbook involves a few simple yet crucial steps. Open Microsoft Excel and generate a new workbook to serve as the foundation for your financial management endeavors. Once your workbook is ready, it’s time to label your sheets appropriately. Consider designating sheets for “Budget,” “Expenses,” and “Savings” to streamline your financial data categorization.

Creating a well-structured foundation for your personal finances is imperative, and that begins with establishing income and expense categories. Within the “Budget” sheet, meticulously document all your income sources along with their corresponding amounts. This provides you with a comprehensive overview of your available funds. Subsequently, create distinct categories to categorize your expenses, differentiating between fixed expenses like rent and bills, and variable expenses such as entertainment and dining out. This categorization sets the stage for a more organized and informed approach to managing your financial resources within the MS Excel framework.

Building Your Budget with MS Excel

Once your categories are set, it’s time to input your financial data.

-

Inputting Your Income

- In the “Budget” sheet, enter your income sources and their amounts. Use Excel’s formulas to calculate the total income.

-

Allocating Funds to Expenses

- Allocate funds to your expense categories based on priority. Excel’s functions help you distribute funds and keep track of allocations.

Tracking Your Expenses

Tracking your expenses is a fundamental practice that plays a vital role in upholding a well-managed budget. It’s the cornerstone of financial awareness and control, allowing you to make informed decisions about your spending habits. Here’s how you can effectively track your expenses using MS Excel:

- Recording Daily Expenditures: Start by creating an “Expenses” sheet within your Excel workbook. This is where you’ll diligently document your daily expenditures. The key here is thoroughness – capture even the minutest expenses, as they can collectively impact your overall budget. Whether it’s your morning coffee, transportation costs, or an impulse purchase, recording each expense provides a clear picture of your spending behavior.

- Be Diligent: Consistency is essential. Make it a habit to input your expenses daily. This ensures accuracy and prevents any expenses from slipping through the cracks. By consistently recording your expenses, you’re actively engaging in a process that empowers you to take control of your financial situation.

- Categorizing and Analyzing Expenses: Once your expenses are recorded, take the extra step to categorize them. Categorization allows you to identify patterns in your spending. Use Excel’s sorting and filtering features to group expenses under categories like groceries, entertainment, utilities, etc. This categorization unveils insights into where your money is predominantly going and helps you make informed decisions about where to cut back or allocate more funds.

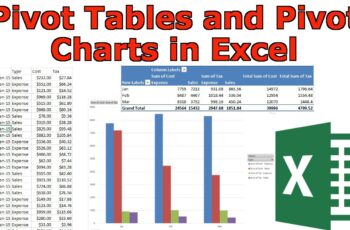

- Gain Insights with Excel: MS Excel provides a wealth of tools to analyze your expenses effectively. Utilize pivot tables and charts to visually represent your spending patterns. These visual aids make it easier to comprehend your financial behavior and identify areas that need attention. For instance, you might notice that your entertainment expenses are disproportionately high, prompting you to explore ways to reduce them.

Incorporating these practices into your financial routine equips you with the knowledge and control needed to manage your expenses effectively and work towards your financial goals.

Utilizing Excel Formulas for Financial Insights

Excel’s formulas can provide valuable insights into your financial situation.

-

Calculating Totals and Subtotals

Use formulas to calculate the total expenses, income, and savings. This gives you a comprehensive view of your financial health.

-

Visualizing Data with Charts and Graphs

Visual representations make it easier to understand your financial data. Create charts and graphs to see trends and make informed decisions.

Tips for Effective Personal Finance Management

To make the most of your financial journey, keep these tips in mind:

Regularly Review Your Budget

Set aside time each month to review your budget. This helps you stay on track and make adjustments if necessary.

Identifying and Reducing Unnecessary Expenses

Analyze your spending habits to identify areas where you can cut back. Redirecting those funds towards savings or investments can greatly benefit your financial goals.

Effective personal finance management is within your reach, and MS Excel is a powerful ally in this journey. By creating a well-structured budget and diligently tracking expenses, you can achieve your financial goals and secure a brighter future.

FAQs

Q1: Can I use Google Sheets instead of MS Excel for personal finance?

A: Absolutely! The principles of budgeting and expense tracking apply regardless of the software you use. Google Sheets offers similar features for financial management.

Q2: How often should I update my budget?

A: It’s recommended to update your budget monthly. This ensures that you’re accounting for all your expenses and making adjustments as needed.

Q3: What’s the benefit of categorizing expenses?

A: Categorizing expenses helps you understand your spending patterns. It allows you to identify areas where you might be overspending and make informed decisions to cut back.

Q4: Should I focus on paying off debt or saving first?

A: It’s a good idea to balance both. Start by building an emergency fund, then focus on high-interest debt. Once debt is manageable, allocate more funds to savings and investments.

Q5: Where can I learn more about investment strategies?

A: There are many online resources, courses, and books available that provide insights into various investment strategies. Make sure to research and understand before making investment decisions.